Template For Donation Receipt

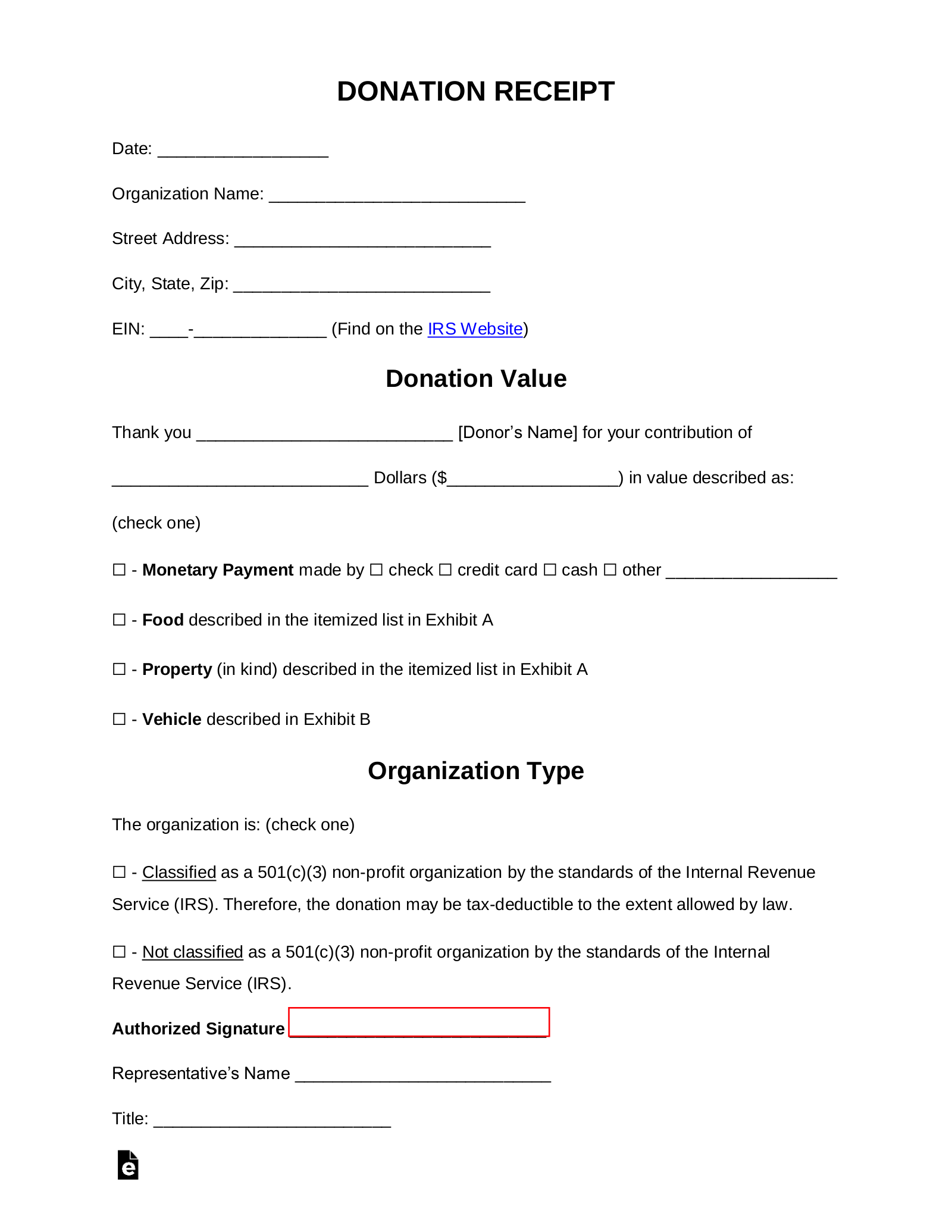

Template For Donation Receipt - Web download this donation receipt template to help properly track donations at your nonprofit and ensure that your donors can claim their gift on their taxes. 6 free templates download nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Get the template what should a donation receipt template include? Web simplify your donation receipt process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. It includes the organization logo, name, federal tax id number, and a statement that verifies that the organization is. Online donation receipts template canada (click image to download in word format) If you’re using sumac nonprofit crm, you can setup your receipts to send automatically after someone makes a donation on your website. 5 are all gifts or donations qualified for goodwill donation receipts? 2 the importance of information receipts for benefactors and beneficiary; In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! There are various types of donation receipts including the following: Sending back compelling and timely donation. There are various types of donation receipts including the following: It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a. Get the template what should a donation receipt template include? Your donors may expect a note at the end of the year totaling their donations. Sending back compelling and timely donation receipts increases the chances of donor retention, and using the right tech solution should minimize the efforts in the process of preparing for the tax season. Web nonprofits must. Web 1 donation receipt templates; It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. The templates provide a standardized format for generating receipts, ensuring donors receive proper charitable contributions documentation and their donations have been recorded and processed appropriately. Web download this donation. In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Your donors may expect a. Web using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Here are some free 501(c)(3) donation receipt templates for you to download and use; 2 the importance of information receipts for benefactors and beneficiary; Yes no, this receipt will be used as a template for multiple donations It is also. Web donation receipt february 24, 1954 thank you for your gift! The templates provide a standardized format for generating receipts, ensuring donors receive proper charitable contributions documentation and their donations have been recorded and processed appropriately. In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a. When you make a charitable donation, it’s your responsibility to make sure to obtain the donation receipt, or you may. 5 are all gifts or donations qualified for goodwill donation receipts? Web donation receipt february 24, 1954 thank you for your gift! Web 1 donation receipt templates; This word must be included at the top of this document. There are various types of donation receipts including the following: In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! Web nonprofits and charitable organizations use these to acknowledge and record contributions from donors. This helps. Here are some free 501(c)(3) donation receipt templates for you to download and use; Web nonprofits and charitable organizations use these to acknowledge and record contributions from donors. This word must be included at the top of this document. When you make a charitable donation, it’s your responsibility to make sure to obtain the donation receipt, or you may. Web. The amount you have given will make a difference as the proceeds will go help put the children to school to give them better education, and thus make them better members of society. Donation receipts generation is an inseparable part of a charity (nonprofit) organization functioning. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: 5 types of donation receipts This blog shares why donation receipts matter to donors and nonprofits, what to include, and how to customize and automate them to save time and raise more funds! 6 creating your donation receipt template; It includes the organization logo, name, federal tax id number, and a statement that verifies that the organization is. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Web nonprofits and charitable organizations use these to acknowledge and record contributions from donors. Web using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. It is also a must part of this receipt. Yes no, this receipt will be used as a template for multiple donations Web nonprofits must send a receipt for any single donation of $250 or more. When you make a charitable donation, it’s your responsibility to make sure to obtain the donation receipt, or you may. Web a person/company making a donation an organization receiving a donation is this receipt for a single donation?

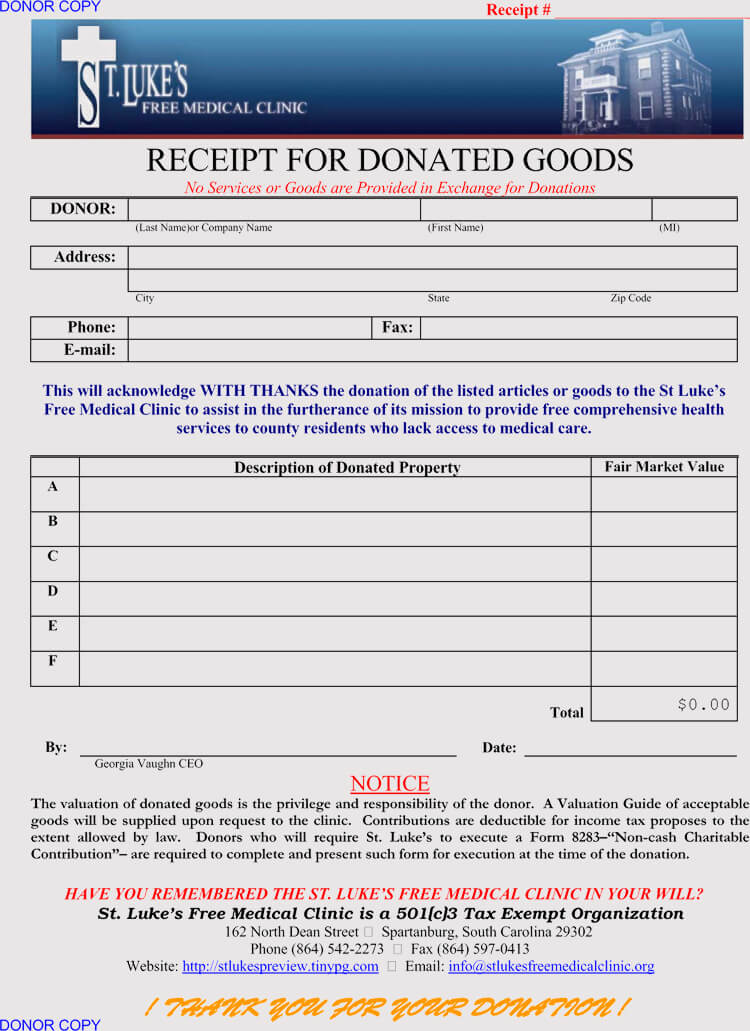

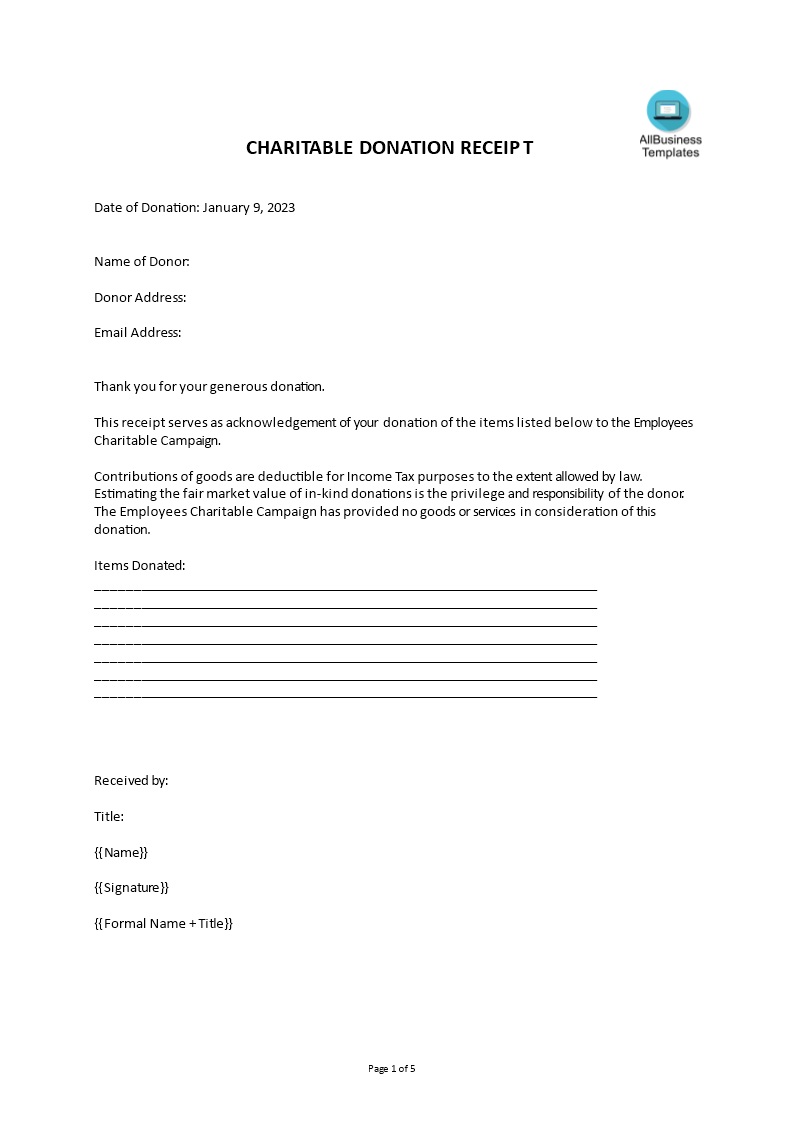

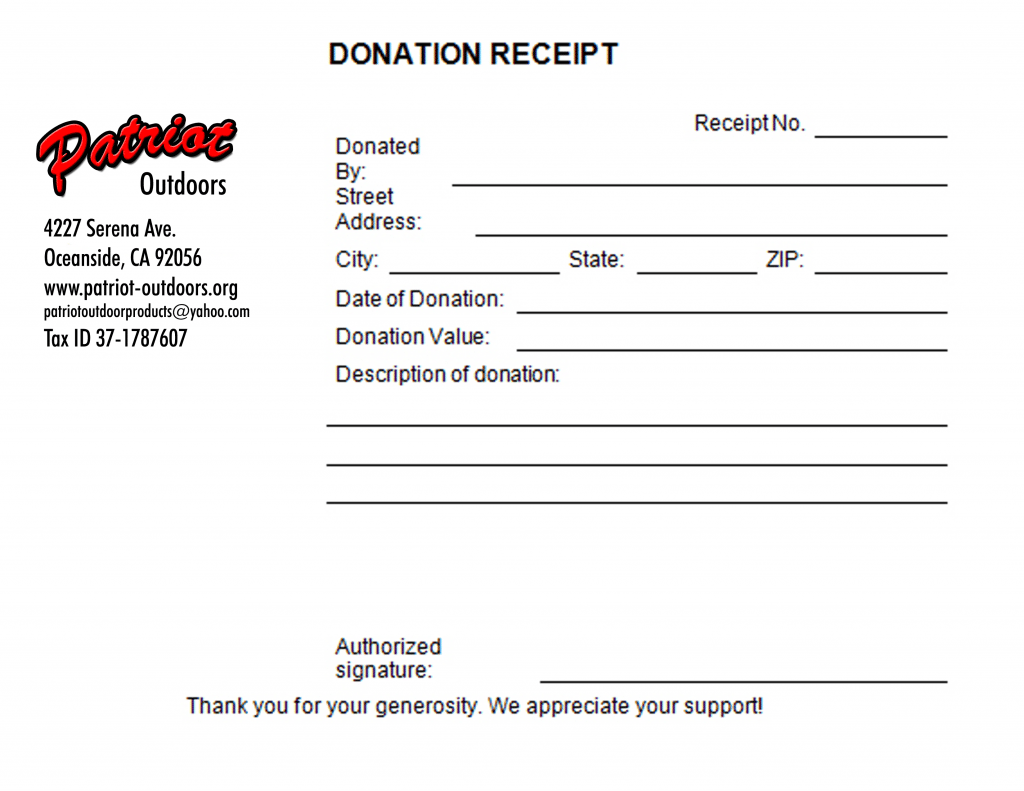

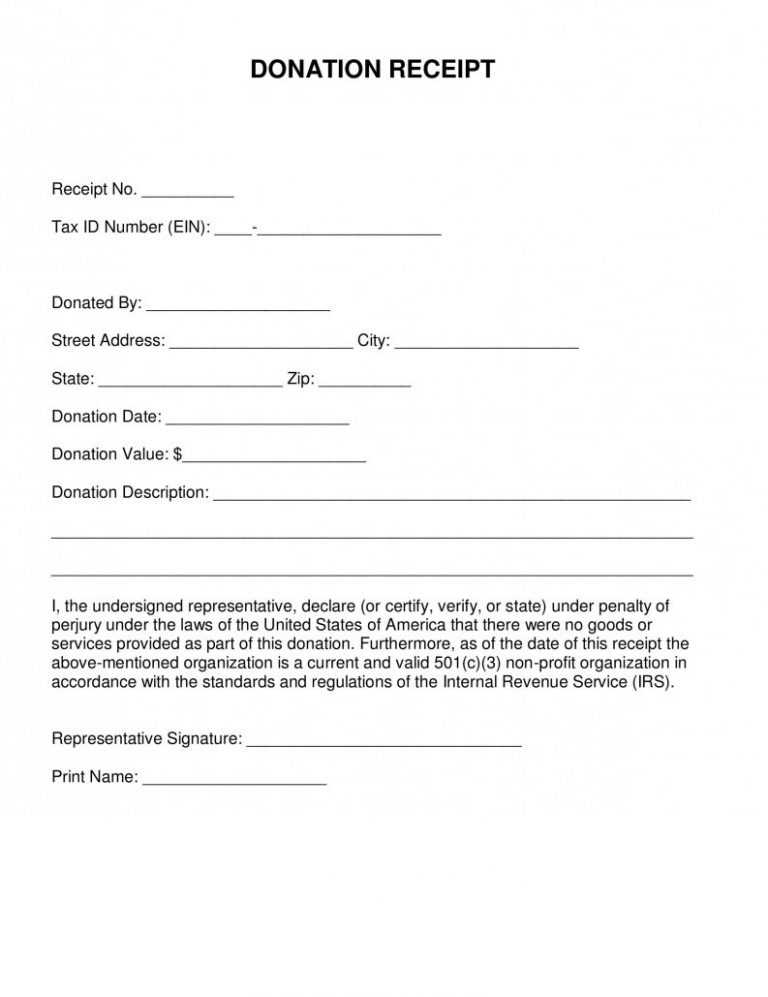

Free Goodwill Donation Receipt Template PDF eForms

46 Free Donation Receipt Templates (501c3, NonProfit)

Donation Receipt Templates 15 Free Printable Templates My Word

8 Charitable Donation Receipt Template Template Guru

Ultimate Guide to the Donation Receipt 7 MustHaves & 6 Templates

Charitable Donation Receipt Template Excel Templates

Free Sample Printable Donation Receipt Template Form

Donation Receipt Template in Microsoft Word

Free Donation Receipt Templates Samples PDF Word eForms

FREE 5+ Donation Receipt Forms in PDF MS Word

This Shows That It Is A Donation Receipt.

Here Are Some Free 501(C)(3) Donation Receipt Templates For You To Download And Use;

Our Donation Receipt Templates Can Help You Quickly Send A Receipt To All Of Your Donors.

In Addition To Showing Donor Appreciation, These Messages Help Your Supporters File Their Annual Income Tax Return Deductions And Help Your Charitable Organization Keep Good Internal Records Of Gifts.

Related Post: