Pre Approval Letter Template

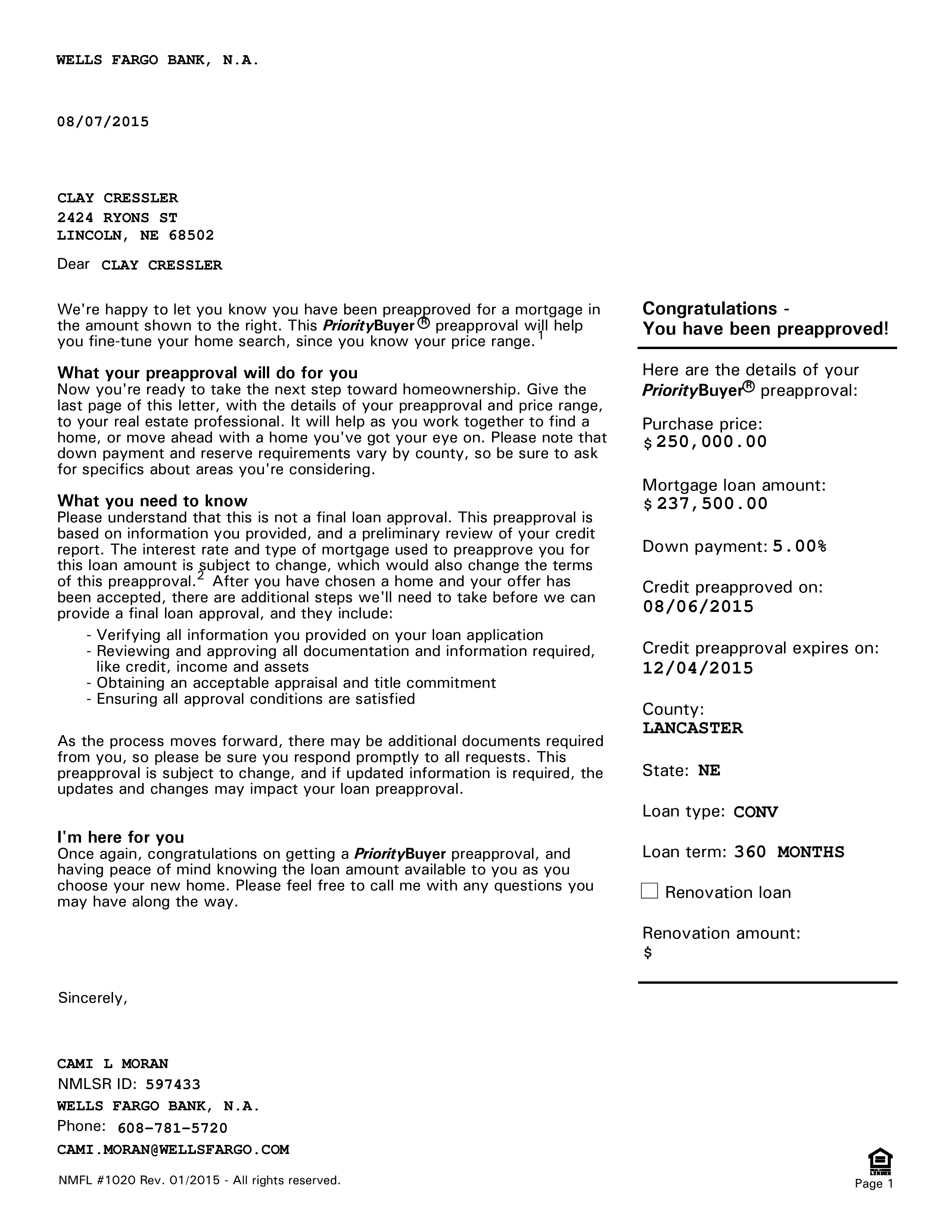

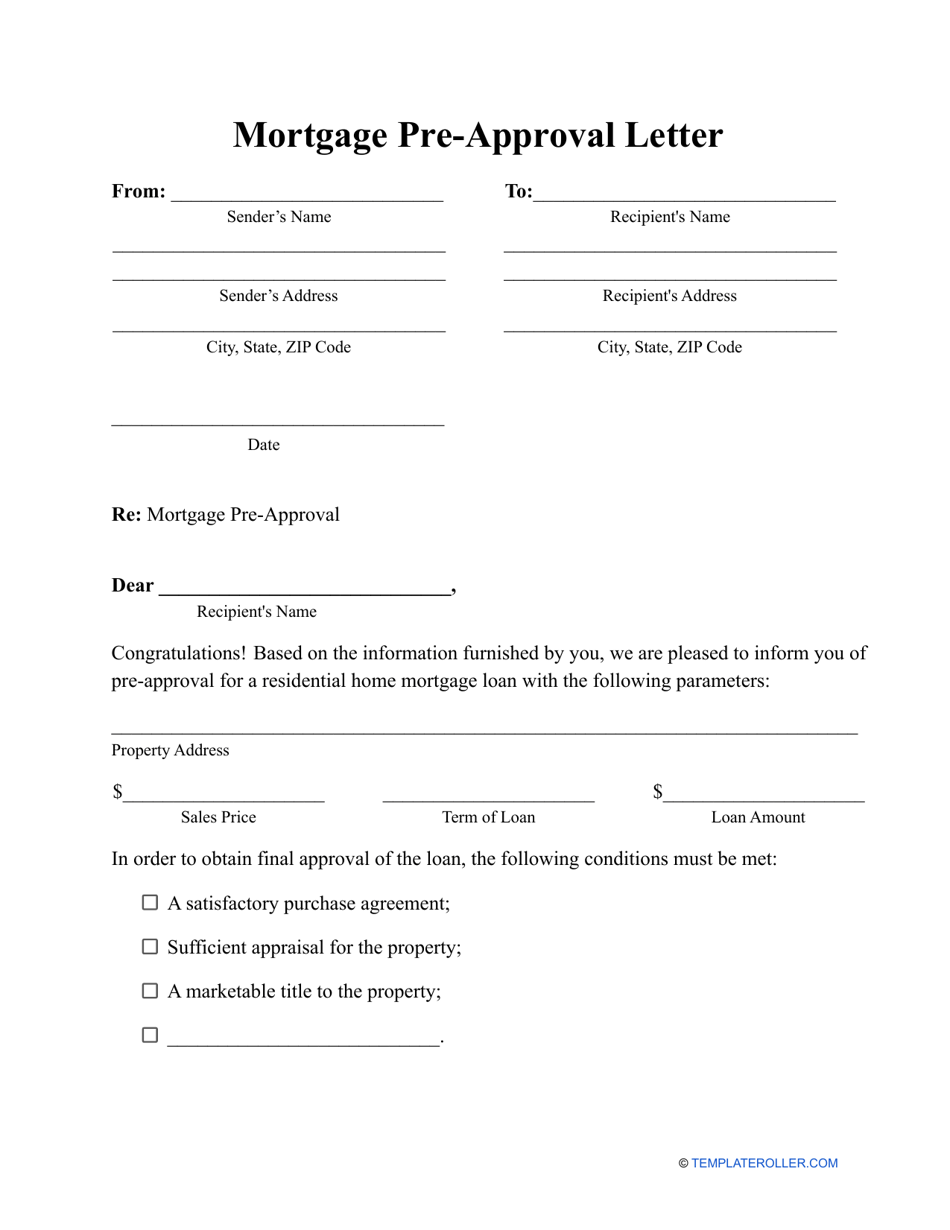

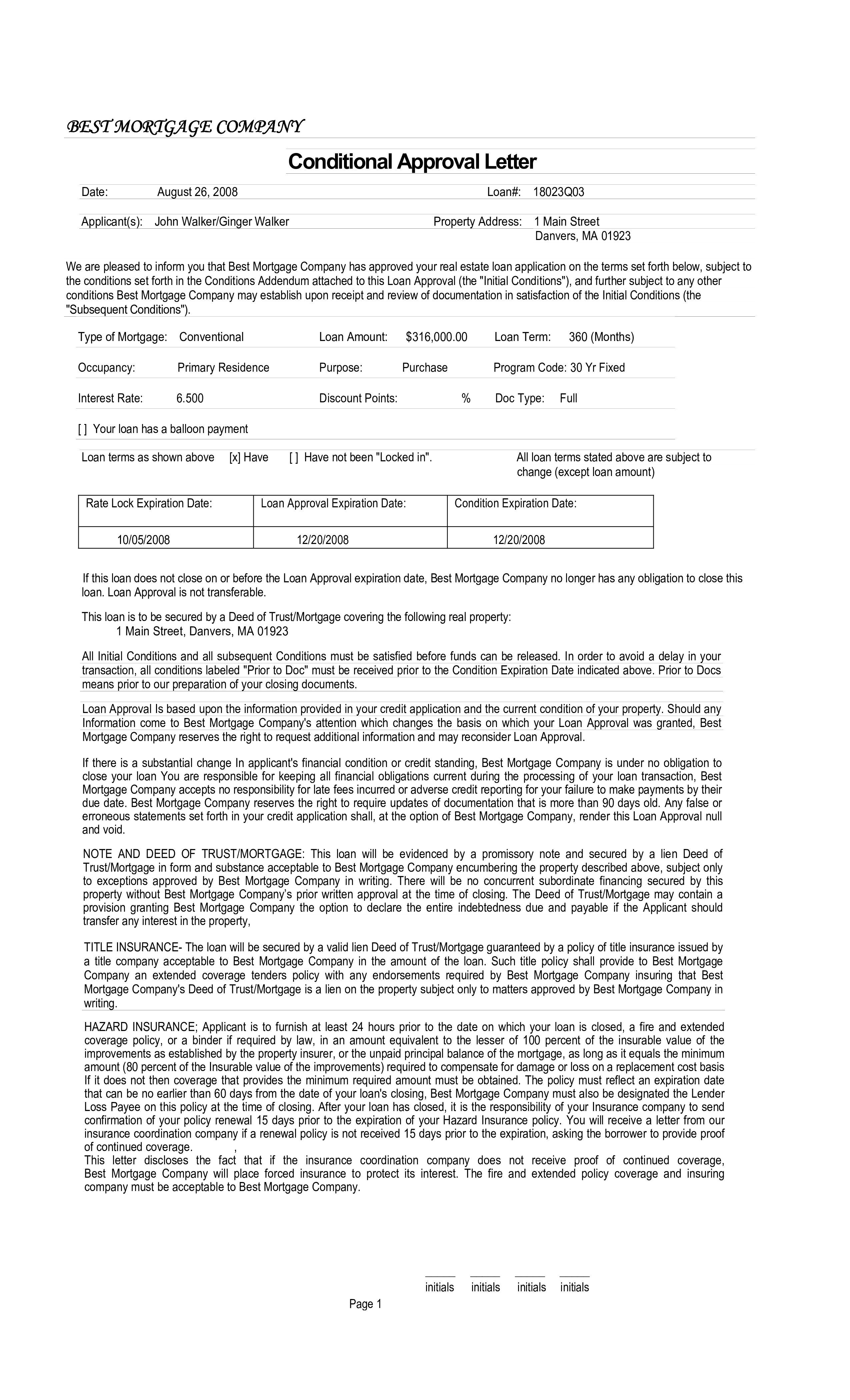

Pre Approval Letter Template - To do this, you will start with baseline content in a document, potentially via a form template. Web in word, you can create a form that others can fill out and save or print. From there, we’ll give you a prequalified approval letter that you can use to shop for homes. Let's make an offer on the blue house. Once you’ve chosen your mortgage option, you can see if you’re approved for it. This is common when a buyer of real estate is looking to make an offer and to prove they can close on the property. Looks like we can afford either house. For an even stronger approval, you can contact a home loan expert to get a verified approval. Web here’s a checklist of what you need to get a mortgage preapproval letter. Key takeaways a mortgage preapproval is a statement of how much money a lender is willing to let you borrow to pay for a home. To get a prioritybuyer ® preapproval letter, you'll submit a mortgage application and the bank will do a limited credit review. Please note that your loan will need to be officially underwritten and given official approval before funding of the property to take place. Web here’s a checklist of what you need to get a mortgage preapproval letter. [mention the. Optionally, these content controls can be linked to. To get a prioritybuyer ® preapproval letter, you'll submit a mortgage application and the bank will do a limited credit review. To do this, you will start with baseline content in a document, potentially via a form template. Some of the most common documents that are required of each borrower. This document. Looks like we can afford either house. Web updated september 13, 2023. Web he sent us the prioritybuyer ® preapproval letter. This indicates to the seller that the buyer is serious about purchasing their home and has taken steps to. Optionally, these content controls can be linked to. Optionally, these content controls can be linked to. This is common when a buyer of real estate is looking to make an offer and to prove they can close on the property. Please note that your loan will need to be officially underwritten and given official approval before funding of the property to take place. Web here are the items. [mention the name of the recipient] [mention the address of the recipient] [mention the contact. Web here’s a checklist of what you need to get a mortgage preapproval letter. Looks like we can afford either house. Lenders will want to see proof of income, assets and credit history. Web here are the items the letter will usually contain: Web in word, you can create a form that others can fill out and save or print. This document is based on certain assumptions and it is not a guaranteed loan offer. Some of the most common documents that are required of each borrower. Please note that your loan will need to be officially underwritten and given official approval before. Lenders will want to see proof of income, assets and credit history. This document is based on certain assumptions and it is not a guaranteed loan offer. Web here’s a checklist of what you need to get a mortgage preapproval letter. Downloading now and start your homebuying journey. Web in word, you can create a form that others can fill. Downloading now and start your homebuying journey. Web in order to obtain final approval of the loan, the following conditions must be met: This document is based on certain assumptions and it is not a guaranteed loan offer. Web in word, you can create a form that others can fill out and save or print. Web a prequalification or preapproval. Web updated september 13, 2023. If you're approved, the agent and seller know you're a. Optionally, these content controls can be linked to. You’ll also need to provide identification and verify your employment. Downloading now and start your homebuying journey. Web get your approval letter. Downloading now and start your homebuying journey. An auto loan preapproval is a conditional approval in which a lender declares they are willing to extend financing, up to a specific price point, to help you purchase a car. Some of the most common documents that are required of each borrower. Web he sent us the. This document is based on certain assumptions and it is not a guaranteed loan offer. [mention the name of the recipient] [mention the address of the recipient] [mention the contact. This indicates to the seller that the buyer is serious about purchasing their home and has taken steps to. Lenders will want to see proof of income, assets and credit history. Once you’ve chosen your mortgage option, you can see if you’re approved for it. From there, we’ll give you a prequalified approval letter that you can use to shop for homes. To do this, it usually highlights the following details: You’ll also need to provide identification and verify your employment. Web in order to obtain final approval of the loan, the following conditions must be met: Please note that your loan will need to be officially underwritten and given official approval before funding of the property to take place. This is common when a buyer of real estate is looking to make an offer and to prove they can close on the property. Optionally, these content controls can be linked to. Web here’s a checklist of what you need to get a mortgage preapproval letter. Web he sent us the prioritybuyer ® preapproval letter. To get a prioritybuyer ® preapproval letter, you'll submit a mortgage application and the bank will do a limited credit review. Mortgages are advantageous in that they give borrowers longer payment periods.

How to Get a Mortgage PreApproval Credible

![Free Printable PreApproval Letter Templates [PDF] & Mortgage & Loan](https://www.typecalendar.com/wp-content/uploads/2023/05/verified-pre-approval-letter.jpg?gid=302)

Free Printable PreApproval Letter Templates [PDF] & Mortgage & Loan

The Mortgage PreApproval Process MTC Federal Credit Union

Pre Approval Mortgage Letter Templates at

Mortgage Preapproval Letter Template Download Printable PDF

FREE 7+ Sample PreApproval Letter Templates in MS Word PDF

FREE 7+ Sample PreApproval Letter Templates in MS Word PDF

Mortgage Pre Approval Letter Templates at

![Free Printable PreApproval Letter Templates [PDF] & Mortgage & Loan](https://www.typecalendar.com/wp-content/uploads/2023/05/pre-approved-letter.jpg)

Free Printable PreApproval Letter Templates [PDF] & Mortgage & Loan

![Free Printable PreApproval Letter Templates [PDF] & Mortgage & Loan](https://www.typecalendar.com/wp-content/uploads/2023/05/pre-approval-mortgage-letter.jpg)

Free Printable PreApproval Letter Templates [PDF] & Mortgage & Loan

Web Get Your Approval Letter.

Let's Make An Offer On The Blue House.

Some Of The Most Common Documents That Are Required Of Each Borrower.

Downloading Now And Start Your Homebuying Journey.

Related Post: