Non Profit Donation Receipt Template

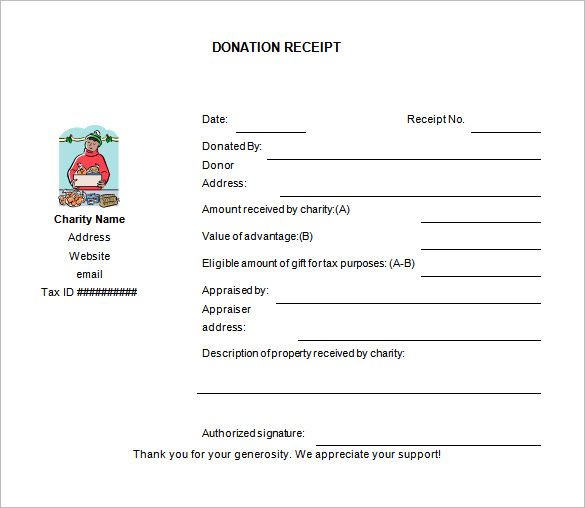

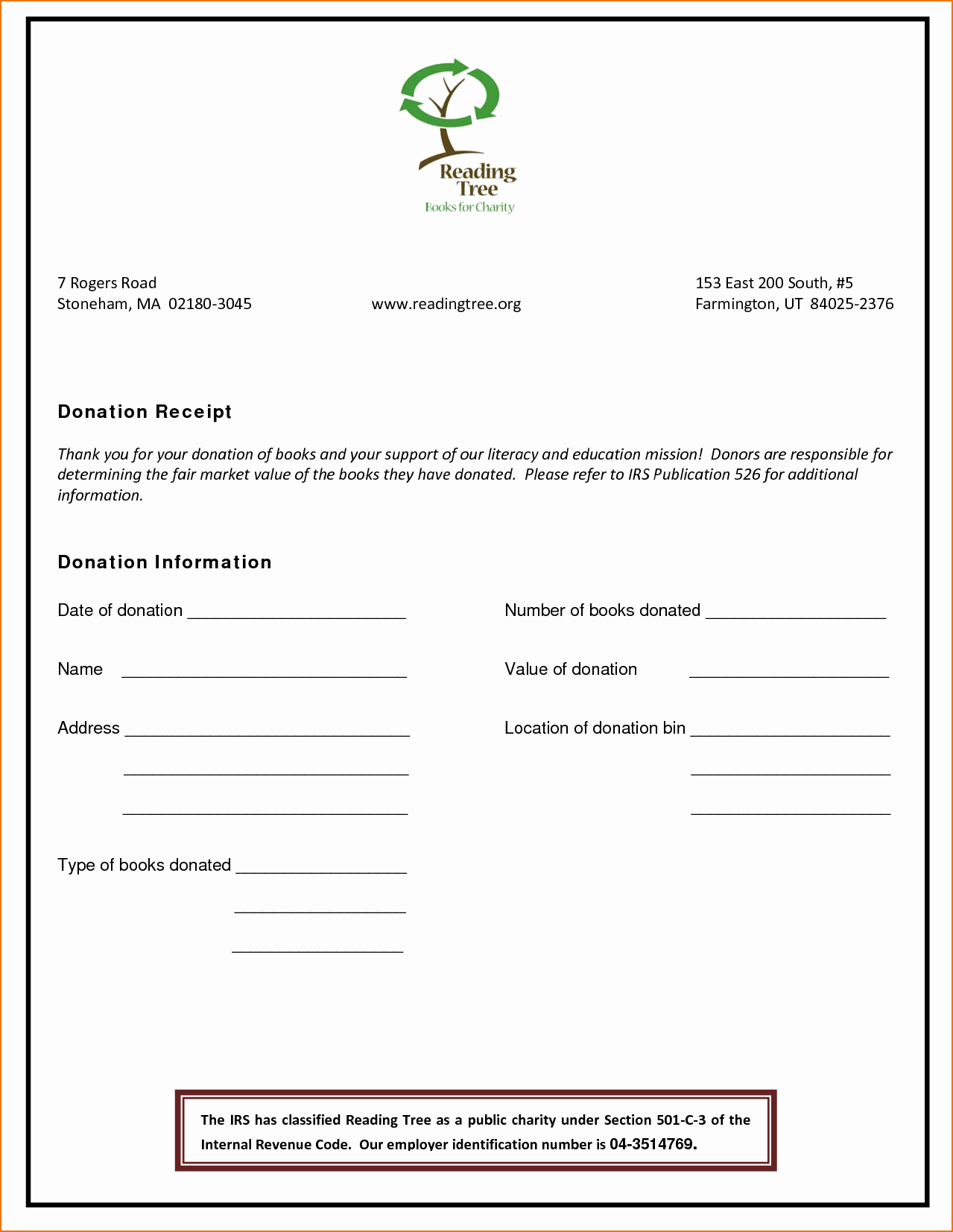

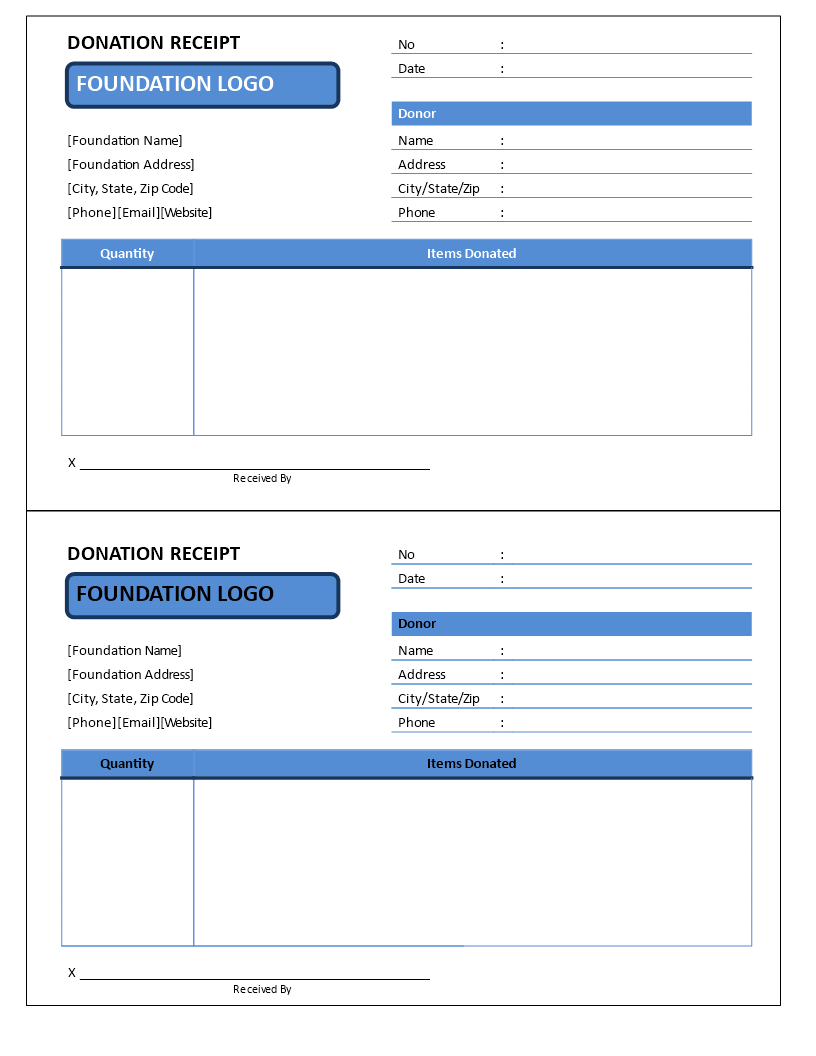

Non Profit Donation Receipt Template - Made to meet canada and the usa requirements. Why do you need a donation receipt? A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It allows you to create and customize the draft of your receipt contents. Scroll down to “enhance your campaign” and click “receipt emails.”. Web free nonprofit donation receipt templates for every giving scenario. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Nonprofit donation receipts make donors happy and are useful for your nonprofit. Under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to. Web donation receipt templates let’s get started! Web here are some best practices to follow when creating a donation receipt template: They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. Try to avoid technical terms or jargon that may confuse donors. Nonprofit donation receipts make donors happy and are useful for your nonprofit. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Try to avoid technical terms or jargon that may confuse donors. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax. Why do you need a donation receipt? It helps taxpayers determine potential tax deductions on their annual filings. Try to avoid technical terms or jargon that may confuse donors. Under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to. It’s utilized by an. Web free nonprofit donation receipt templates for every giving scenario. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. Nonprofit donation receipts make donors happy and are useful for your nonprofit. Use our easy template editor. Made to meet canada and the usa requirements. Web donation receipt templates let’s get started! Nonprofit donation receipts make donors happy and are useful for your nonprofit. Under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to. Why do you need a donation receipt? Scroll down to “enhance your campaign” and. When is a nonprofit donation receipt required? The charity organization that receives the donation should provide a receipt with their details included. Use our easy template editor. Under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to. Web check out this solution for. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. It helps taxpayers determine potential tax deductions on their annual filings. Web free nonprofit donation receipt templates for every giving scenario. The organization should also fill in their details and. It’s utilized by an individual that has donated cash or payment, personal property,. The charity organization that receives the donation should provide a receipt with their details included. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web donation receipt templates let’s get started! Nonprofit donation receipts make donors happy and are useful for your nonprofit.. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. It helps taxpayers determine potential tax deductions on their annual filings. Try to avoid technical terms or jargon that may confuse donors. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of. Nonprofit donation receipts make donors happy and are useful for your nonprofit. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Web free nonprofit donation receipt templates for every giving scenario. Use our easy template editor. You also have the ability to attach a pdf of the donation. When is a nonprofit donation receipt required? Try to avoid technical terms or jargon that may confuse donors. The organization should also fill in their details and. Under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to. Web donation receipt templates let’s get started! Web free nonprofit donation receipt templates for every giving scenario. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Made to meet canada and the usa requirements. It helps taxpayers determine potential tax deductions on their annual filings. Web here are some best practices to follow when creating a donation receipt template: Nonprofit donation receipts make donors happy and are useful for your nonprofit. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. Web check out this solution for more info. Why do you need a donation receipt? They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction.

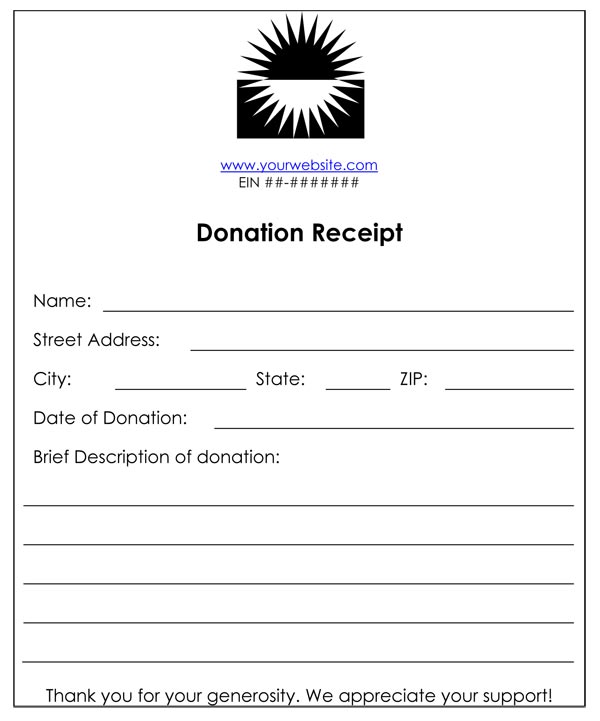

Non Profit Receipt Template printable receipt template

Free Printable Donation Receipt Template Printable Templates

Free Nonprofit (Donation) Receipt Templates (Forms)

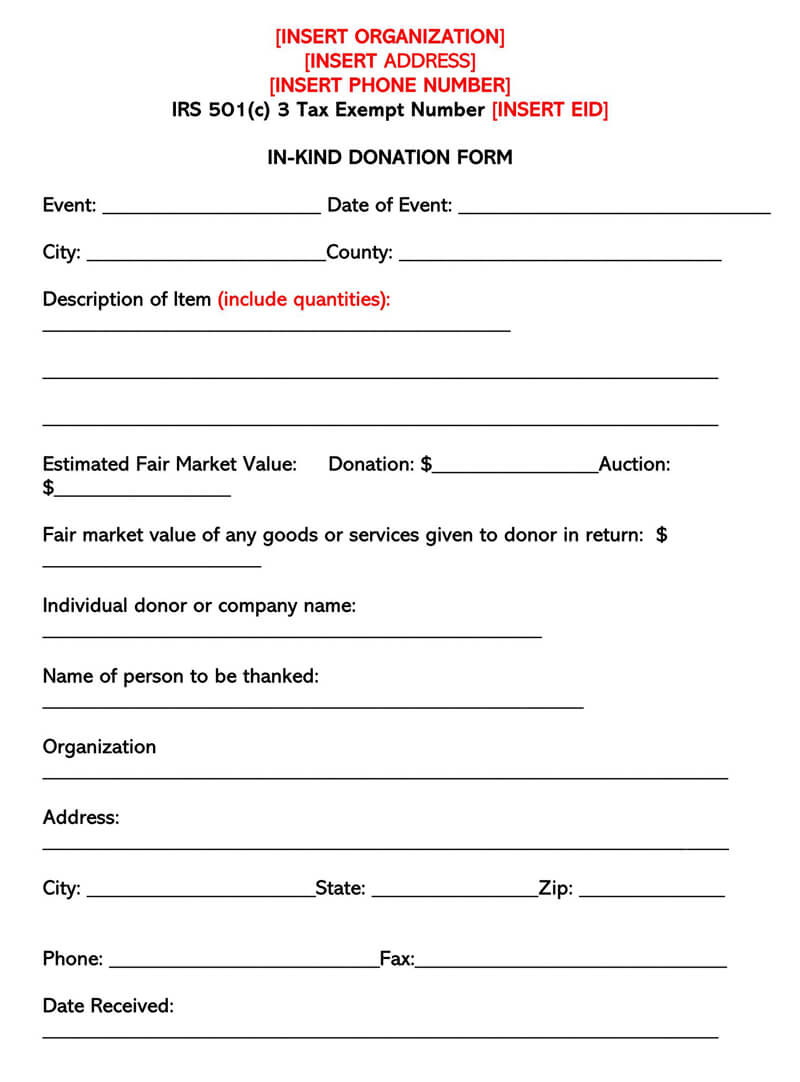

FREE 8+ Sample Donation Receipt Forms in PDF Excel

30 Non Profit Donation Receipt Templates (PDF, Word) PrintableTemplates

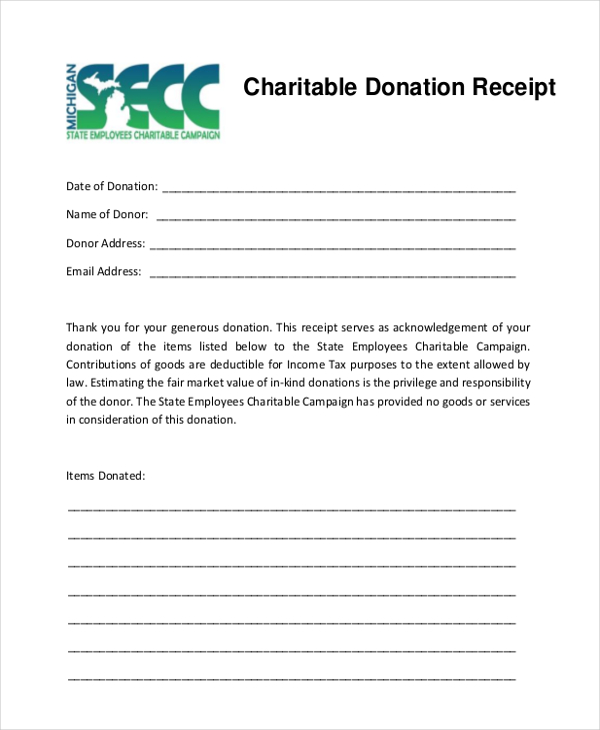

Nonprofit Receipt 5+ Examples, Format, Pdf Examples

Non Profit Donation Receipt Template Excel Templates

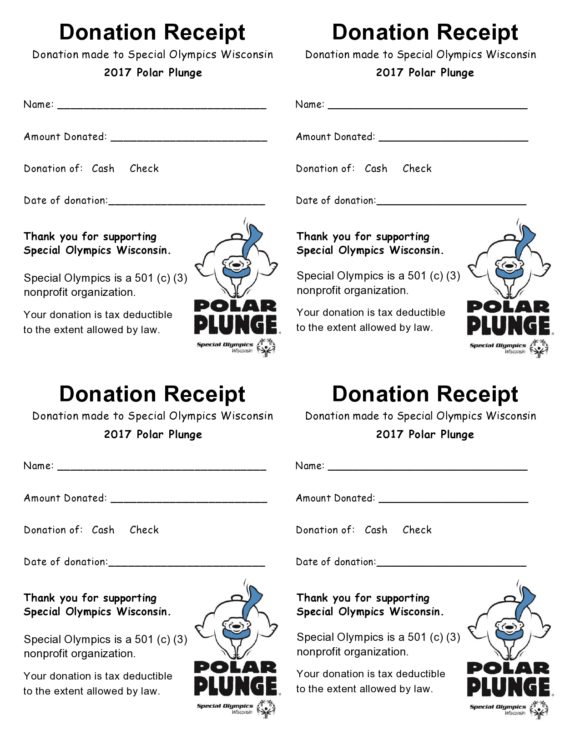

Non profit donation receipt template Templates at

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-40.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Scroll Down To “Enhance Your Campaign” And Click “Receipt Emails.”.

It Allows You To Create And Customize The Draft Of Your Receipt Contents.

The Charity Organization That Receives The Donation Should Provide A Receipt With Their Details Included.

Web These Email And Letter Templates Will Help You Create Compelling Donation Receipts Without Taking Your Time Away From Your Donors:

Related Post: