Donation Invoice Template

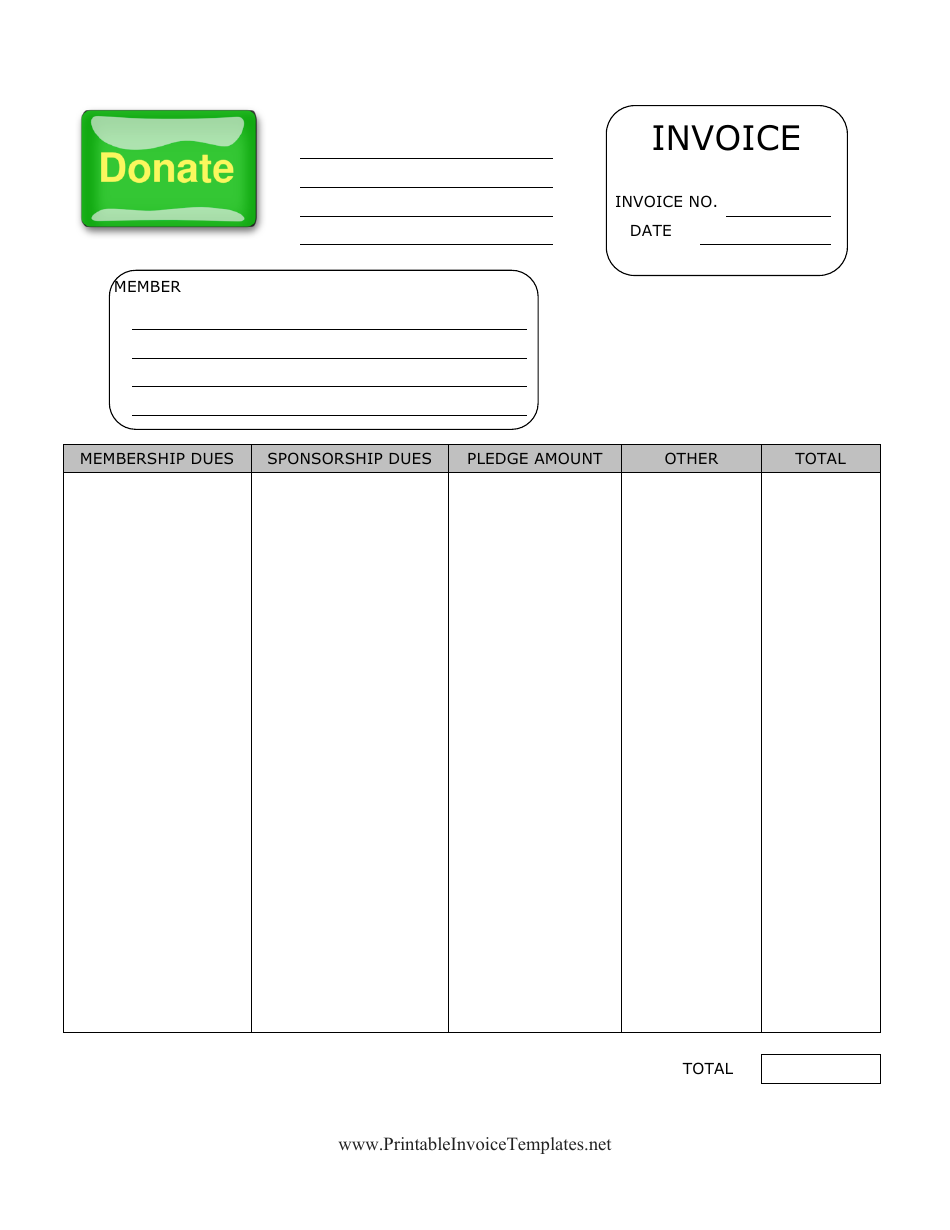

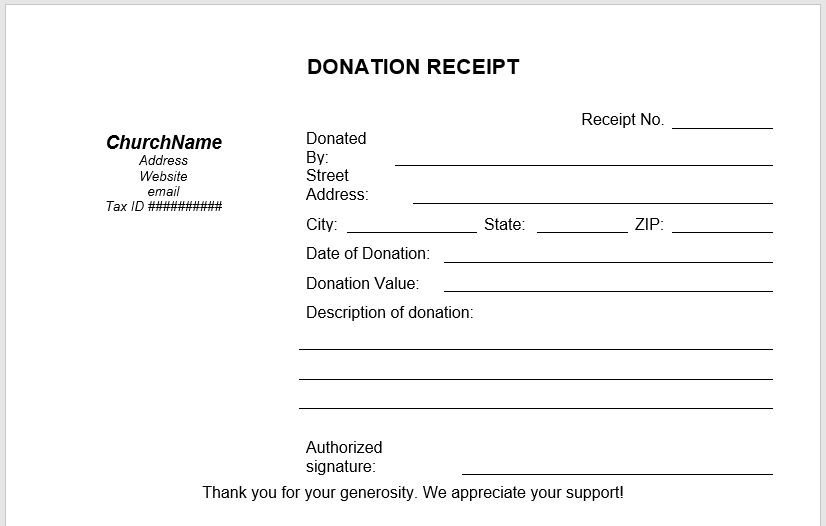

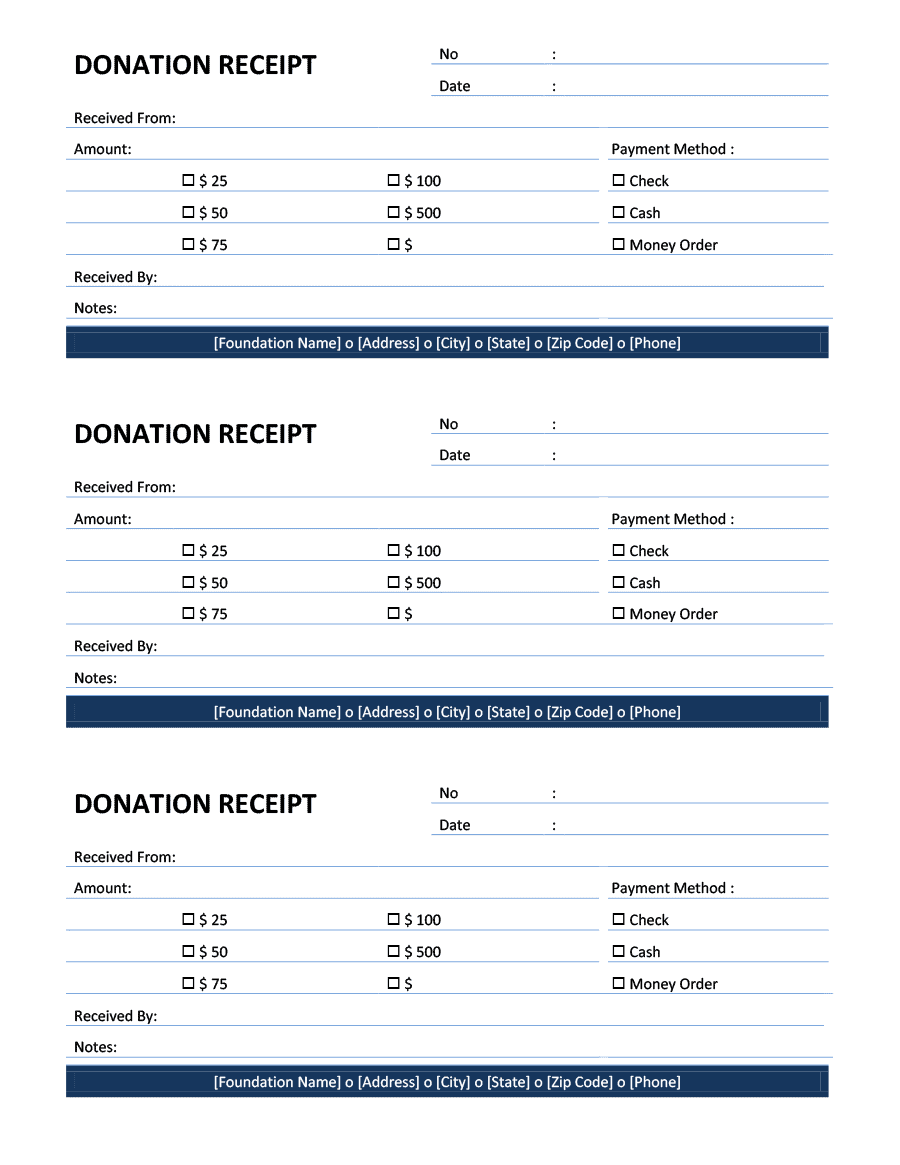

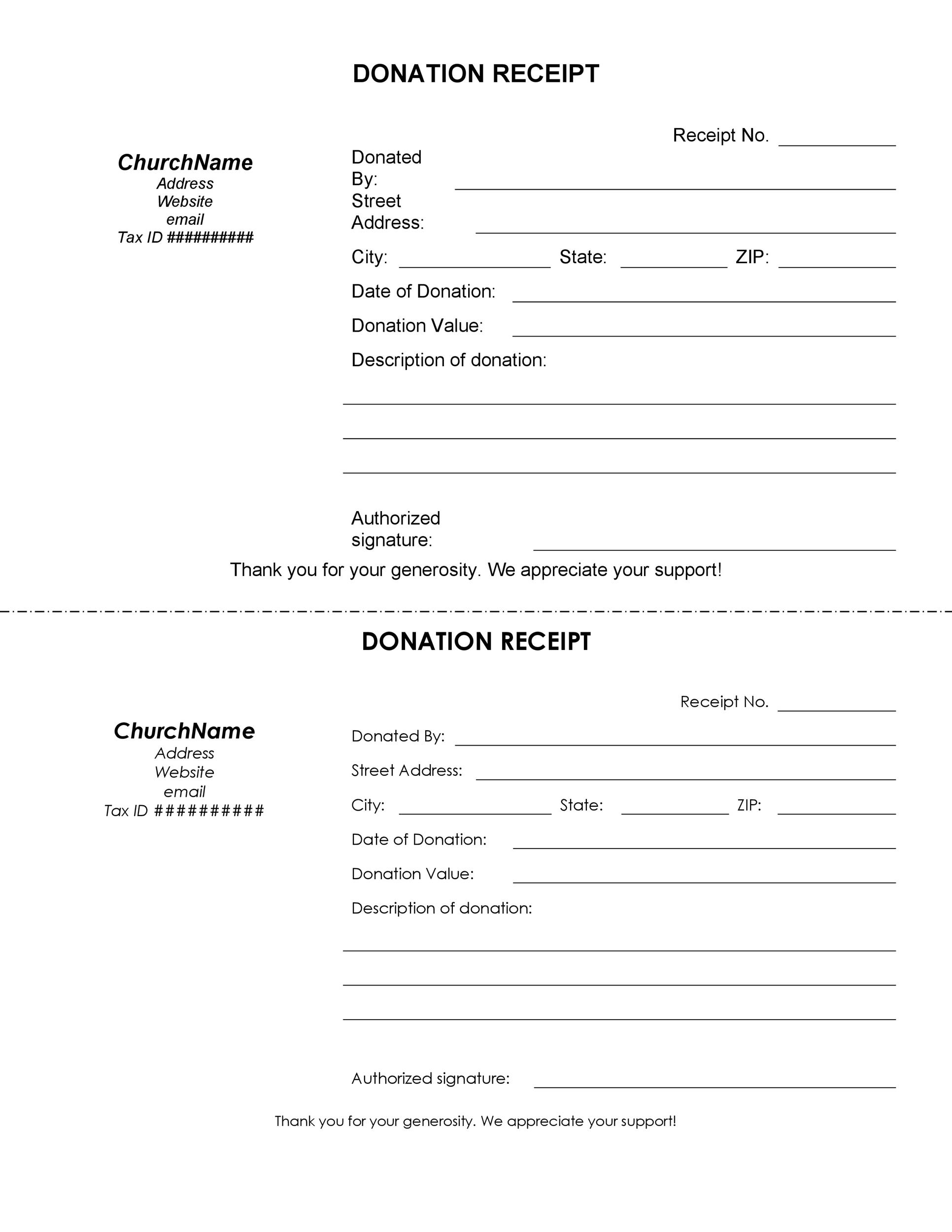

Donation Invoice Template - Web ready to transform your donation tracking? Virginia create document updated december 18, 2023 a donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. It’s people like you who make what we do possible. Maybe your donors want to fill in a specific donation amount—after all, susan’s lucky number is 269.32! This donation receipt will act as official proof of the contribution, and help donors claim a tax deduction. Registered nonprofit organizations can issue both “official donation tax receipts” and more informal receipts. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Kosmo’s donation invoice template is free to use, and you can receive payments online with automatic late payment reminders. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Maybe your donors want to fill in a specific donation amount—after all, susan’s lucky number is 269.32! The template offers three essential donation invoice customization options: What is a donation receipt? Web here’s our collection of donation receipt templates. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to. Kosmo’s donation invoice template is free to use, and you can receive payments online with automatic late payment reminders. For more templates, refer to our main receipt templates page here. Virginia create document updated december 18, 2023 a donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual,. Web your donation receipt template needs these 5 things. Download our free donation invoice templates to easily make and send. Web billing for donations doesn’t have to be a headache. Kosmo’s donation invoice template is free to use, and you can receive payments online with automatic late payment reminders. One requirement is that you give donors a donation receipt, also. Add a purchase order number, your company's logo, and sales tax. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. Make a free invoice now. Web with clickup's invoice template for donation, you can streamline the. Generate professional and customized invoices with ease. One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). With kosmo’s donation invoice template, you can quickly and easily send invoices to your donors. Including a picture like this helps connect the donor to the people that will benefit from their gift and reinforces their. Add a purchase order number, your company's logo, and sales tax. Including a picture like this helps connect the donor to the people that will benefit from their gift and reinforces their connection to. Web skynova's invoice template allows you to customize entries to suit your specific needs. Kosmo’s donation invoice template is free to use, and you can receive. Be sure to include the type of donation, the amount or value, and each party’s contact information. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Virginia create document updated december 18, 2023 a donation receipt is used by companies and individuals in order to provide proof that cash or property was. This donation receipt opens with a great image of a student and a tutor working together. This article outlines everything you need to know about what a donation invoice is, how to create one, and the top five things you should always include when crafting your own. It eliminates the need to work with cumbersome documents. Select the one that. Feel free to download, modify and use any you like. It’s people like you who make what we do possible. The template offers three essential donation invoice customization options: This article outlines everything you need to know about what a donation invoice is, how to create one, and the top five things you should always include when crafting your own.. This donation receipt will act as official proof of the contribution, and help donors claim a tax deduction. Feel free to download, modify and use any you like. The type of gift commonly ranges from payment (cash, credit card, etc.), personal property (clothing, furniture, etc.), or food. Web billing for donations doesn’t have to be a headache. Web download the. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web with clickup's invoice template for donation, you can streamline the process of creating and sending invoices, ensuring that every contribution is properly documented. Registered nonprofit organizations can issue both “official donation tax receipts” and more informal receipts. Select the one that fits in with your cause, and download the invoice template in the format you use, such as word, excel, pdf, google docs, or google sheets. The template offers three essential donation invoice customization options: Web here’s our collection of donation receipt templates. Generate professional and customized invoices with ease. Maybe your donors want to fill in a specific donation amount—after all, susan’s lucky number is 269.32! Download donation invoice template and other quote templates in word, excel, pdf, google docs and sheets. This template allows you to: Add a purchase order number, your company's logo, and sales tax. Web download the donation invoice template, which acts as a receipt for the donor and the recipient to record the donation’s details. Web billing for donations doesn’t have to be a headache. For more templates, refer to our main receipt templates page here. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status.

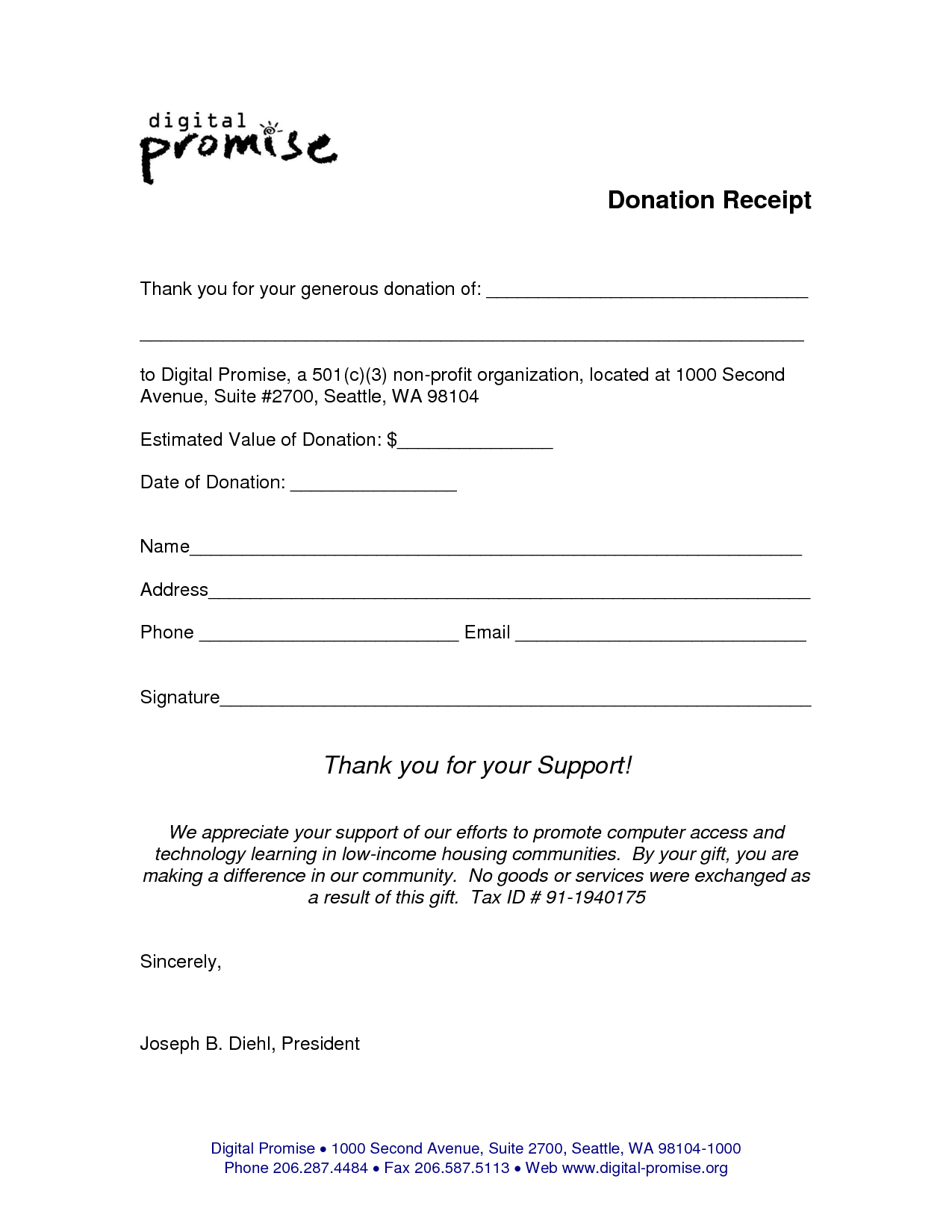

Donation Invoice Template Fill Out, Sign Online and Download PDF

Microsoft word donation receipt template bdaontheweb

Form For Charitable Donation Receipt Master of Documents

Microsoft word donation receipt template paneldax

Donation Receipt Template BestTemplatess BestTemplatess

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

Donation Receipt Template in Microsoft Word

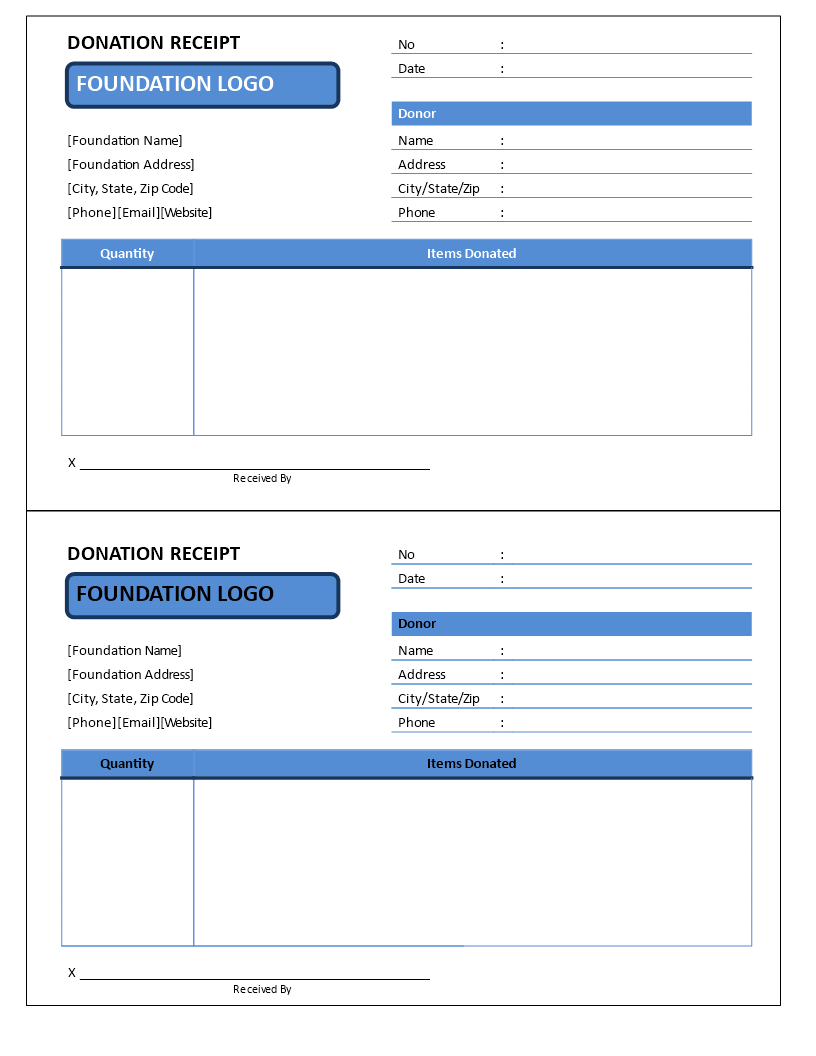

Non Profit Donation Receipt Template Excel Templates

In Kind Donation Receipt Template For Your Needs

Donation Receipt 10+ Examples, Format, Pdf Examples

Web Skynova's Invoice Template Allows You To Customize Entries To Suit Your Specific Needs.

A 501 (C) (3) Donation Receipt Is Required To Be Completed By Charitable Organizations When Receiving Gifts In A Value Of $250 Or More.

One Requirement Is That You Give Donors A Donation Receipt, Also Known As A 501 (C) (3).

This Donation Receipt Will Act As Official Proof Of The Contribution, And Help Donors Claim A Tax Deduction.

Related Post: